With sugared beverages responsible for the No. 1 source of calories in the American diet or accounting for 7% the average American’s daily calorie intake. For children and teenagers, the percentage of soda can reach 10% of a day’s calories.

These numbers are hard to ignore and provide evidence that the soda consumption in America is ever present in daily society. While many admit the sugared beverage consumption is out of control, the method of solving the situation is not as in accordance.

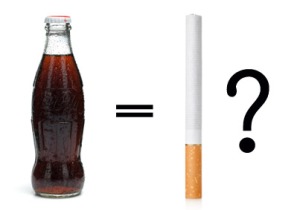

Some parties fail to see the similarities between tobacco and sugar addiction. Yet, the effective tax on tobacco has led to a curb in tobacco use and decreased health costs. The big question is, can the same happen with soda? Talks about soda taxes has been abuzz for a while and while nothing has come to fruition yet.

Advocates of a soda tax argue it would reduce soda reduction, reduce annual per capita consumption of soda by more than eleven gallons, pay for anti obesity campaigns and most importantly decrease health care costs and increase overall health! Dr. Brownell and Thomas Frieden, CDC Director and former NYC health commissioner stated implementation of a soda tax would raise $1.2 billion annually on a penny per ounce soda tax! Potential suggestions for the $1.2 billion revenue include subsidizing fruits and vegetables, funding obesity prevention programs, home ec classes in schools, etc.

There’s a lot effective tools that can be taken from the tobacco tax model–similar addictive qualities and inexplainable causes . Since the tobacco tax, smoking has been cut in half. Yet, the odds of a successful ban are stacked against the ban. The American Beverage Association has shelled out billions against the tax and an ineffective soda tax could lead to public health mistrust. Moreover, some argue such taxes would hurt low income households that are already struggling to obtain affordable food choices.

So, for future success, health advocates need to team up with the food industry instead of against. With soda as the largest source of added sugar in the American diet and offers no nutritional value as a source of empty calories. Yes, soda is not the only culprit for the rise in obesity, but it has done its fair share of damage. Children, teenagers, and young adults would be most affected by a soda tax as they have less money than adults. Presumably, this would decrease their consumption of sugar sweetened beverages (SSB), which will help prevent lifelong bad habits of added sugar.

Only time will tell how the food industry, government and public react to future soda taxes and/or bans. What side are you on?

References

1. Watts, R., Heiss, S., Moser, M., Kolodinsky, J., & Johnson, R. (2014). Tobacco taxes vs soda taxes: A case study of a framing debate in vermont. Health Behavior and Policy Review, 1(3), 191-196. doi:http://dx.doi.org/10.14485/HBPR.1.3.3

2. Cornelsen, L., Green, R., Dangour, A., & Smith, R. (2014). Why fat taxes won’t make us thin. J Public Health, doi:10.1093/pubmed/fdu032

http://vickygarciafitness.com/sodas-impact-body/

http://www.drfranklipman.com/is-big-soda-the-new-tobacco-industry/